Sign Up For Free To Keep Reading

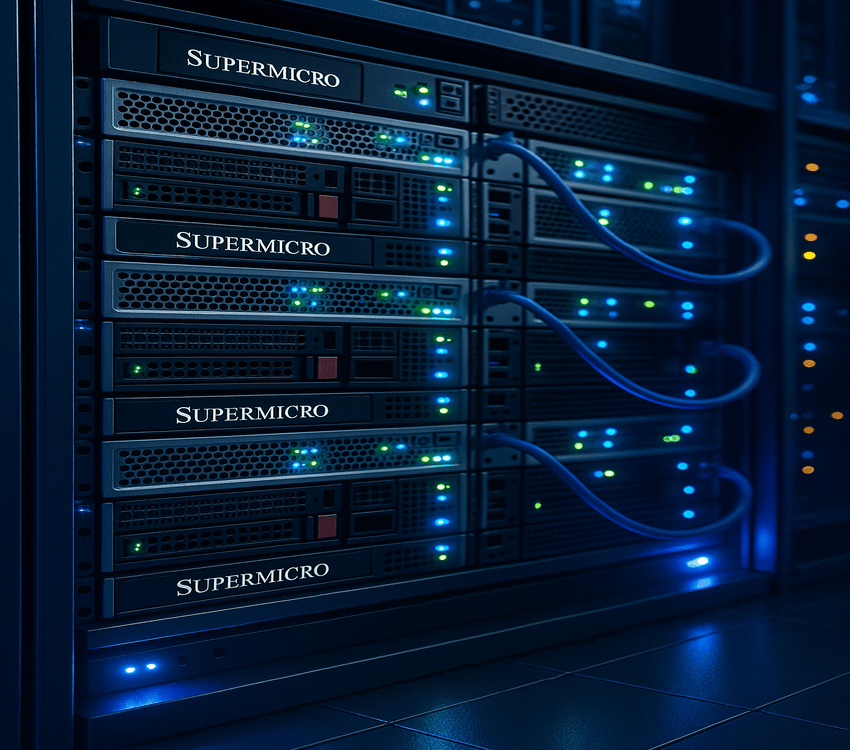

Shares of Super Micro Computer (NASDAQ: SMCI) rallied sharply this week, climbing over 5% and marking one of the strongest performances within the S&P 500. The surge came after the company unveiled a significant strategic partnership with Nokia to build integrated AI data-center solutions. The announcement, made on September 9, 2025, underscores Super Micro’s ongoing push into high-performance AI infrastructure and bolsters its visibility in a sector facing intense competitive pressure. This new alliance leverages Super Micro’s hardware and Nokia’s software-defined data-center capabilities to create a joint solution targeted at AI computing workloads. Coming off a volatile period that included a disappointing earnings report and lingering investor concerns about market share losses to rivals like Dell and Hewlett Packard Enterprise, the Nokia announcement appears to have restored confidence in Super Micro’s roadmap. As shares rebounded from their recent lows, market participants are now parsing the implications of this partnership for future growth, customer acquisition, and Super Micro’s longer-term competitive positioning.

Strategic AI Alliance With Nokia Positions Super Micro For Growth

The newly announced partnership between Super Micro and Nokia is strategically structured to create an end-to-end AI data center platform, combining Super Micro’s hardware, including its latest rack-scale liquid-cooled servers, with Nokia’s network operating systems and data-center automation solutions. This is not just a hardware-software pairing—it is an ecosystem play aimed at enterprises and governments looking to deploy AI workloads at scale. By integrating their offerings, the two companies can provide modular, easily deployable data-center infrastructure tailored for advanced AI applications, especially in regions where sovereign AI deployments are ramping up. From a technological standpoint, the collaboration strengthens Super Micro’s data center building block solution (DCBBS) initiative, which focuses on faster time-to-market and energy-efficient deployments. According to the company’s Q4 FY25 earnings call, DCBBS components like direct liquid cooling (DLC), battery backup units (BBU), and modular power solutions are already in production and being shipped to key customers. Super Micro has emphasized its readiness to support next-gen GPUs such as NVIDIA’s B300 and GB300, and AMD’s MI350/355X, with system-level integration. Nokia’s software stack enhances that proposition by offering automation and orchestration—critical elements for hyperscale deployments. This positions Super Micro to serve as a one-stop shop, enabling customers to bypass complex third-party integrations. The strategic alignment with Nokia is expected to not only help win new business but also support margin expansion by shifting from commoditized server sales to higher-value integrated solutions. Moreover, in a year when availability constraints around high-end GPUs are expected to ease, the timing of this partnership may allow Super Micro to capture a disproportionate share of upcoming AI data center investments.

Partnership Seen As Catalyst For Customer Expansion

The Nokia partnership arrives at a time when Super Micro is actively seeking to expand its large-scale customer base. In fiscal 2025, the company doubled its 10%+ customers from two to four, and management has projected adding several more in fiscal 2026. This strategic alliance is expected to significantly improve Super Micro’s ability to win over both hyperscalers and sovereign AI customers. Management emphasized during the earnings call that the modular DCBBS architecture enables customers to reduce data center build times from 2–3 years to just 18 months—or even as little as 3–6 months for existing site retrofits. This shorter deployment cycle is a critical factor for enterprises and governments trying to rapidly scale AI capabilities. The collaboration with Nokia enhances Super Micro’s appeal to these customers by offering automation, software-defined infrastructure, and end-to-end support—a shift that is particularly attractive for sovereign AI projects in Europe and Asia, where demand for localized infrastructure is accelerating. The company is already working with multiple governments, and the Nokia announcement could further validate Super Micro’s credentials as a turnkey provider. Meanwhile, Super Micro’s enterprise-focused solutions have been tailored for hybrid cloud, edge AI, and telecom applications—segments with higher margins and longer sales cycles. The Nokia software stack adds value in these verticals, enabling automated provisioning and improved system management. As Super Micro diversifies its revenue away from commodity server sales and builds a more enterprise-heavy mix, the Nokia partnership could serve as a major catalyst for attracting new clients while deepening existing engagements. This positions Super Micro for top-line growth as well as improved customer retention, two areas of concern following its recent earnings miss.

Positive Market Reaction Signals Restored Confidence

The market’s immediate response to the Nokia announcement was notably bullish, with Super Micro shares jumping 5.5% in a single trading session. This surge follows a period of substantial volatility—the stock remains down nearly 30% from its July 2025 peak despite a 39% gain year-to-date. The rally suggests that investors view the Nokia collaboration as a meaningful counterbalance to recent concerns, including Super Micro’s Q4 FY25 earnings miss and declining margins. Specifically, the company reported a non-GAAP gross margin of 9.6% for the quarter, down from 11.2% for the full year and significantly lower than its long-term target of 15–17%. However, management reiterated that margins are expected to improve over time as DCBBS adoption ramps and the mix shifts toward software, services, and high-value rack-scale systems. Investor optimism also reflects confidence in Super Micro’s ability to capitalize on easing supply constraints in next-gen GPU platforms. With orders delayed due to NVIDIA chip availability and customer product cycle decisions, the back half of FY26 is expected to see more linear revenue recognition. Super Micro guided for Q1 FY26 revenues between $6–$7 billion, with a full-year target of at least $33 billion—implying a significant ramp in the December and March quarters. Notably, CFO David Weigand emphasized that customers are now engaging with Super Micro earlier in their AI infrastructure planning cycles, which could accelerate order conversion timelines. Altogether, the Nokia deal appears to have reassured investors about both growth visibility and Super Micro’s ability to differentiate in a crowded market.

Execution Risks Remain Amid Competition & Past Misses

Despite the positive momentum from the Nokia partnership, execution risks remain elevated for Super Micro. The company’s recent financial results have been mixed, with Q4 FY25 earnings falling below expectations. Non-GAAP EPS of $0.41 marked a year-over-year decline and was attributed to lower gross margins and higher operating expenses. Tariffs and delayed revenue recognition from a large customer due to specification changes were also cited as factors. While these issues are reportedly behind them, with orders now expected to be recognized in upcoming quarters, they highlight the operational complexity Super Micro faces. Moreover, competition in the AI server space is intensifying. Established players like Dell Technologies and Hewlett Packard Enterprise have expanded aggressively into AI-optimized infrastructure, often leveraging longstanding customer relationships and global scale. Super Micro’s ability to compete hinges on maintaining its advantage in time-to-market, customization, and now, integrated solutions through DCBBS. However, these advantages may not be sustainable without continued investment in R&D, manufacturing capacity, and global logistics. The company is also navigating margin pressure as it balances high-volume deployments with the transition to a higher-margin solution and service model. The current gross margin of under 10% suggests that while top-line growth is strong, profitability remains constrained. Furthermore, guidance for Q1 FY26 implies limited operating leverage despite an anticipated $1 billion sequential revenue uptick. Investors will likely scrutinize execution around DCBBS, particularly whether it delivers the promised scale, customer wins, and margin uplift. In short, while the Nokia deal opens new opportunities, Super Micro must demonstrate sustained execution across a broader and more complex product and customer landscape.

Key Takeaways

Super Micro’s stock surge following the announcement of its AI-focused partnership with Nokia reflects renewed investor optimism around the company’s strategic positioning and growth trajectory. The collaboration aligns with Super Micro’s broader push into data center building block solutions and high-value AI infrastructure, and early indications suggest it could drive meaningful customer expansion and margin improvement. However, the company remains under pressure to improve operational efficiency and prove out the economics of its DCBBS model amid stiff competition from larger incumbents. From a valuation standpoint, as of September 10, 2025, Super Micro trades at an LTM EV/EBITDA multiple of 19.81x and an LTM P/E of 26.17x. While these figures are elevated relative to prior quarters, they appear to price in both upside from the AI buildout and risks from execution shortfalls. Investors will likely monitor upcoming quarters for margin recovery, customer momentum, and the scalability of Super Micro’s integrated offerings to assess whether the stock can sustain its recent gains.